For some reason there are two copies of this in this blog, this one is the older and more original. Mike Habek after reading my last article, kindly sent me a copy of Geoffrey Moore’s article “Just Shoot Me!”, which was published in Under the Buzz, Nov 2002. The article is subtitled “Managing the Services Function inside a Products Company”. Moore believes that the service functions of product companies are trapped inside a life cycle inimicable to optimal service strategies, but that by understanding the cyclical nature of these factors, management can build valuable and valued service delivery companies. …

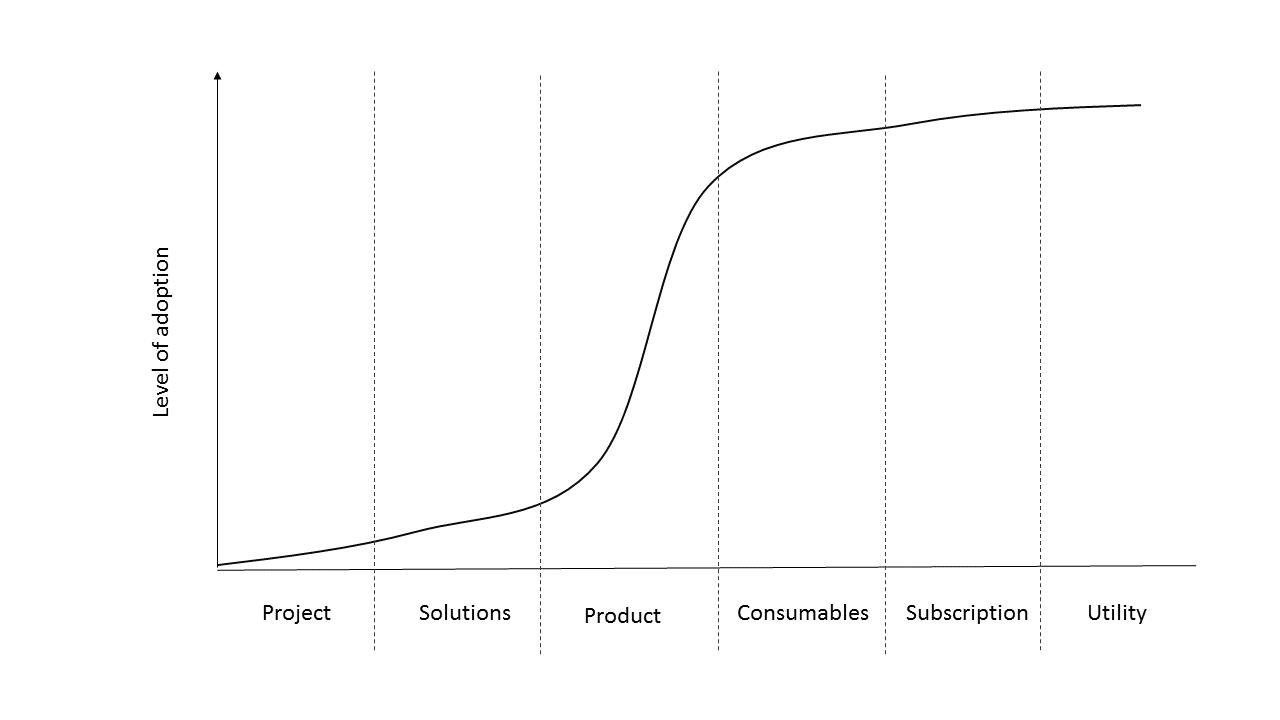

The first thing Moore does is construct a model that places the product business model within a life cycle. The business model needs to evolve in order for the company to succeed throughout the product’s life cycle, and the business model requires differing types and quantity of service to support or effect the sale. The product life cycle exists within a technology adoption cycle. Moore identifies six business models, the project , the solutions , the product , consumables, subscription and outsourcing/utility models1 within the product life cycle.

The project model is appropriate for early adopters and Moore states,

“At the onset of a new technology,…..early customers are ..willing to fund specific instances of this infrastructure..to gain competitive advantage. The model is 20% tools and products, 80% custom labor (sic), so it is expensive and time consuming, but it is also highly differentiating to the customer. Consulting service providers are the key leaders ….they can enjoy high margins on revenues.

It’s also a fact that it’s the people that make it happen, without them, the product will not be sold. the reference cases won’t be created and the market impetus for mass adoption won’t occur. In order to compete in the project phase of the product life cycle, service providers need to optimise themselves. Their sales culture and execution, and leadership needs to orientated around recruiting, maintaining and motivated the best talent to allow the company to win this sort of business. Salesmanship tends to be “consultative”, and the talent leverage (See Maister &/or Levy) aimed at delivering projects to customers looking for competitive advantage. Moore uses the example of Amazon & Cisco’s development of e-commerce infrastructures as examples of significant project model opportunities. So was Sun’s development of the “Architecture.com” mass consumer portal technology for the mobile telco sector.

It is an essential part of the model that the market metamorphoses into a more mature state. The project sponsor’s and consulting supplier’s competitors both look to catchup and the intellectual property moves from the minds of the projects consultants and architects to the application ISVs. This phase of the life cycle Moore refers to as the solutions model. Customers are looking to negate the bleeding edge adopter’s competitive advantage but also leverage high reliability & lower cost. Consulting firms still play an important role in solutions model delivery, but the stage is shared with the applications vendors2,3. For a products company, this remains a development phase of the market.

The market will again mutate and pass through the product phase, which is characterised by transactional efficiency, a consumables phase with high volume recurring product revenues with the amount of product revenue in the product revenue mix increasing to 100%, the mutations continue through competitive pressure and new services need to be offered to create a subscription model, as the company drives up its service income, the final (and in some cases alternative to subscription) is the outsource/utility business model, where product is cost and 100% of revenues is service.

The table below also illustrates the changing nature of the business model over time and over the phases of technology adoption.

| Model | Product/ Service |

Customers | Customer Value | Vendor Value |

| Project | 20:80 | Bleeding Edge | Competitive Advantage | High Margin, Value pricing |

| Solution | 50:50 | Early Adopters | 1st Division Player | Leverage Re-Use |

| Product | 80:20 | Mass Market, knowledgeable buyers | Transactional Efficiency | High Revenue |

| Consumables | 100:0 | Mass Market, consumer buyers | Transactional Efficiency | recurring low value product revenue |

| Subscription | 20:80 | Mass Market, consumer buyers | Cost predictability | regular income based on value added services |

| Utility | 0:100 | Complex requirements | Transparent benefit acquisition | Market Supply |

Moore’s original article offers useful and compelling examples of product businesses in different stages of the life cycle, and more comprehensive definitions of each stage, together with the economic factors that lead to stage transition. This is supplemented by some interesting and varied examples of how product companies create added value services to their product offerings, frequently offering a inter-company partnering dimension.

The constraint identified by Moore is that if a service provider optimises for a specific business model and market, then Maister’s three goals of Service, Satisfaction & Success, can be met, but because the service entities of product companies are not allowed to specialise; they need to meet the product companies full life cycle needs. Moore suggests that a captive’s charter might be as follows, a quote again from his article,

- Be competitive at the front end in project effectiveness

- Be competitive at the back end in transactional efficiency

- But don’t compete so hard that we alienate our service providers

- Be a revenue source, often in a big way and

- Be highly profitable with good utilization

- But find a way to support whatever the sales force has sold

- Oh, and help close top-tier prospects (no charge)

- Oh, and help rescue flagship accounts in trouble (also gratis)

Moore argues that no single one of these goals is impossible, its the combination of all of them together that are. This is a reflection of Maister’s arguments that one can’t optimise for the delivery of all three of expertise, experience and efficiency. The captive service provider’s can try and follow the product’s life cycle and morph with the requirements of product sales, but the pendulum swing from project consultancy services to product installs (if that) through to utility supplier is massive change and organisations have investment gestation periods to make these changes. By the time that a product has matured to later stages in the life cycle, the consultants required to launch it, have been let go, and there is no-one left to make the sales of the products replacement. Sadly Moore does not illustrate this cycle of failure with any examples.

Moore does suggest that there is a way out. Its necessary to understanding the problem by applying the life cycle/business model analysis, deciding what to do and recognising that it can’t all be done. This means that companies need to decide what they’ll do directly, and what they’ll partner to allow customers to acquire the services they need. Of course, partnering implies either market creation activity (like Microsoft) or channel harmony strategies. Each offering to each stage of the market should be managed separately and delivered into an environment where customer satisfaction is measured. Separate divisions, managers, goals and strategies will allow a services company to offer support to the product company throughout the life cycle.

I find Moore’s service life cycle modelling both interesting and compelling and his proposals as to how to respond are quite sensible. Its not actually a great leap for Sun since Sun have over the last few years presented its direct service offerings in at least three forms, professional services, educational services and sustaining support4, although the lack of clarity of how to sell, and what customers will value could have been better managed. The Moore ‘life cycle model’ suggest insights into how Sun can do better by its customers and partners.

Sun’s current organisational plans should mean that customers receive a clearer offer of value to them but the issue of maintaining project & solutions capability remains one of Sun’s key challenges, as does the enablement of its partners to sell within all stages of the life cycle.

ooOOOoo

- The words used here are Moore’s, Sun & others may be using the words differently, for a fuller understanding of what he means, read the original.

- I wonder what happens in the applications world where business requirements are so unique that developing a market is difficult . Mutation to the solutions market would be inhibited. The responses seem to be two fold: large project sponsors ‘newco’ their IT departments to monetise their software investment e.g. LIFFE market solutions or JP Morgan’s “Arcordia” (RIP), or players in the project market work to develop continued differentiation and ensure that the requirement is only available through project model markets e.g. Logica’s projects business.

- IT platform architects often describe infrastructure software components as an application.

- Sun has varied the services and organisational basis for sustaining support, using its solutions centre, field services and centre’s of excellence in varying combinations to meet customer need.

ooOOOoo

This article was copied to this blog in April 2015; the diagram was added at that point. I think the article has stood the test of time better than some but I also think that nearly 10 years later we can see, that in particular the forecasts about utility as a stage of technology adoption are poor; it’s possible that the best examples, which I believe were weak in Moore’s paper, come from the entertainment industry, with products such as Spotify and itunes being utility consumption of storage (& content). An alternative view is that utility offerings need to be designed from the bottom up and are not an evolution of a product strategy.