This is a long diatribe at Hacker Noon about the Bitcoin bubble and the blockchain hype. I had been considering writing something similar although my focus was on the excessive use & cost of electricity to “mine” coins and the demonstrable industrialisation and economic consolidation of the mining operations.

Bitcoin, in particular, has a shrinking use as a means of exchange, as identified by this business insider preview of a Morgan Stanley opinion. This is compounded by the fact that the transaction fees are now too high for small or micro payments, and that it is not real time, (it can take minutes to clear) and thus cannot be used for transactions that require simultaneous exchange, be it a cup of coffee or a house.

The block chain does not scale well, despite the massively distributed architecture. If its performance is matched with say Visa or other significant global payment processors, VISA is rated at 60,000 transactions/sec (TPS) where as the Bitcoin maxes out at 7 TPS. So not only is it expensive, but it can’t cope with real world volume; it’s just as well that small transactions are deserting the platform.

What started me thinking this time round, was the realisation that the amount of power required to “mine” the currency grows and is now significant. While the compensation for the miners is scrip/free, the real cost in electricity and thus carbon pollution is significant. This adds to the cost, both internal but more importantly the external cost. The planet cannot afford the electricity power and the carbon footprint to virtualise global capitalism’s money supply.

Kai Stinchcombe argues that the lack of regulation is also a disincentive to use crypto currencies and examines the Etherium/DAO hack and draws the conclusion that on the whole society needs contracts to be interpreted by people, not by software.

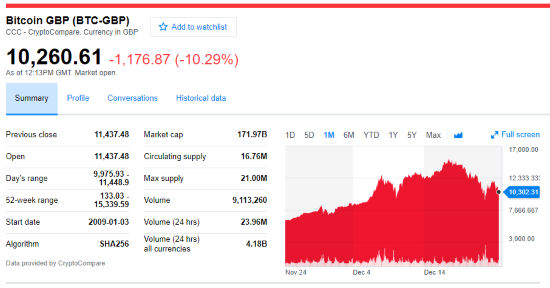

Money must be a means of exchange, and a store of wealth, block-chain crypto-currencies are struggling and increasingly failing to be the former and it’s current price peaks , historic volatility and lack of regulator suggests it’s weak as the latter. Is it just a con? …